ME BANK

Improving the digital application and customer onboarding experience

THE GIG

Product Owner - Online Originations: 12/2018 - 08/2021

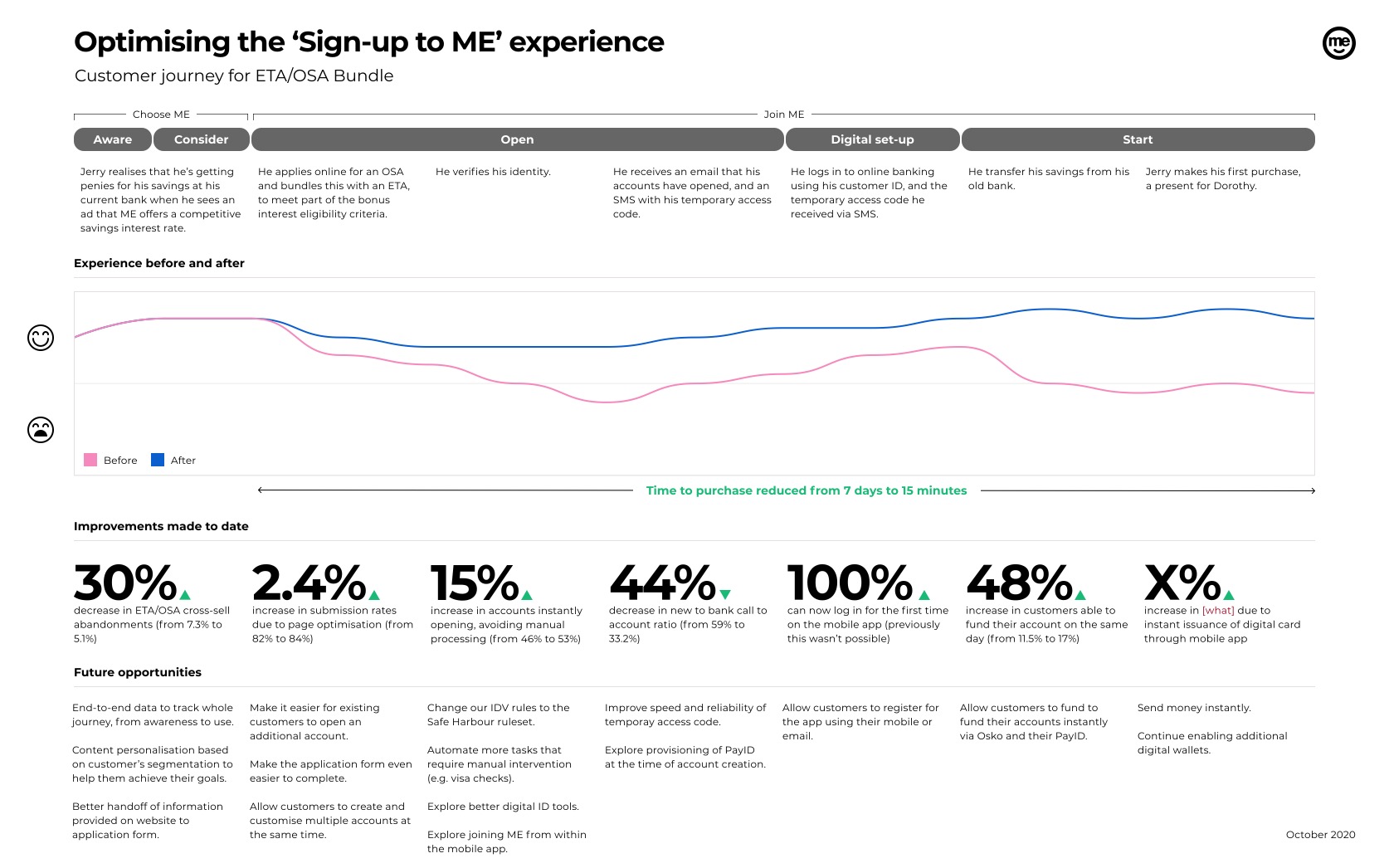

The Digital Product Owner of ME’s online application and onboarding process for retail products, tasked with making sure a customer’s first day, week and month are the best they can be. This meant owning the digital experience across transactions and savings, term deposits, personal loans and credit cards, including some of the 'digital' aspects of the bank's home loan application process.

Prior to this role being created, there was no dedicated owner of the online application forms. Things were worked on ad hoc or whenever there was project funding to spin up temporary teams. There was little consistency and a very high chance that an online application would require manual processing to approve/reject. I was tasked with forming a new long-lived team to delvier frequent and valuable change to improve the customer experience and maximise organisational value.

WHAT WAS REQUIRED

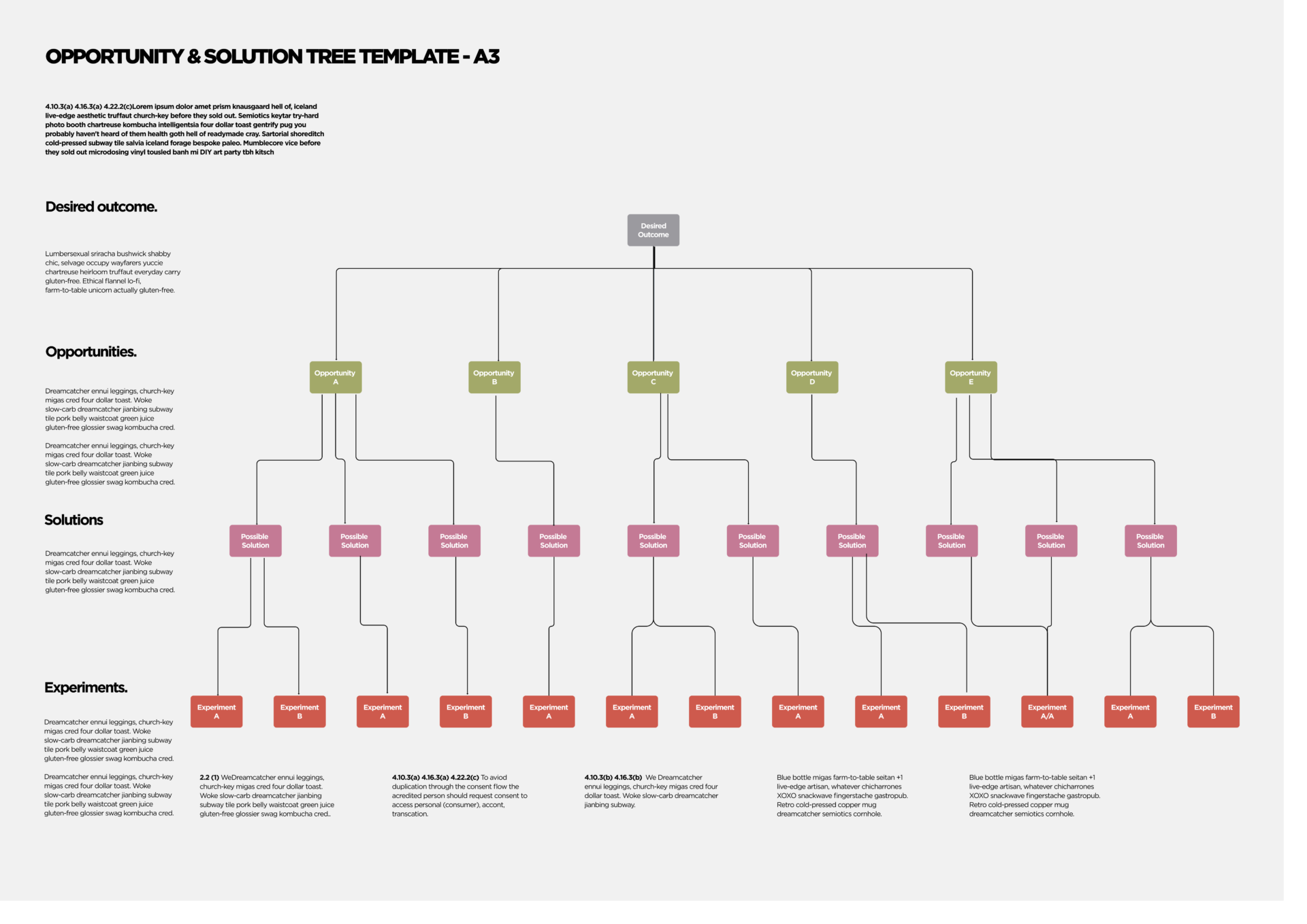

Ideation, discovery & experimentation

Google Analytics, NPS feedback, LEAN process improvement sessions and collective ideation helped gather and inform areas of improvements. We created Opportunity Solution Trees, inspired by Teresa Torress, for each of the key outcomes/metrics we wanted to influence. Then enabled a continuous discovery process to take ideas through impact analysis and customer testing.

Backlog ownership & prioritisation

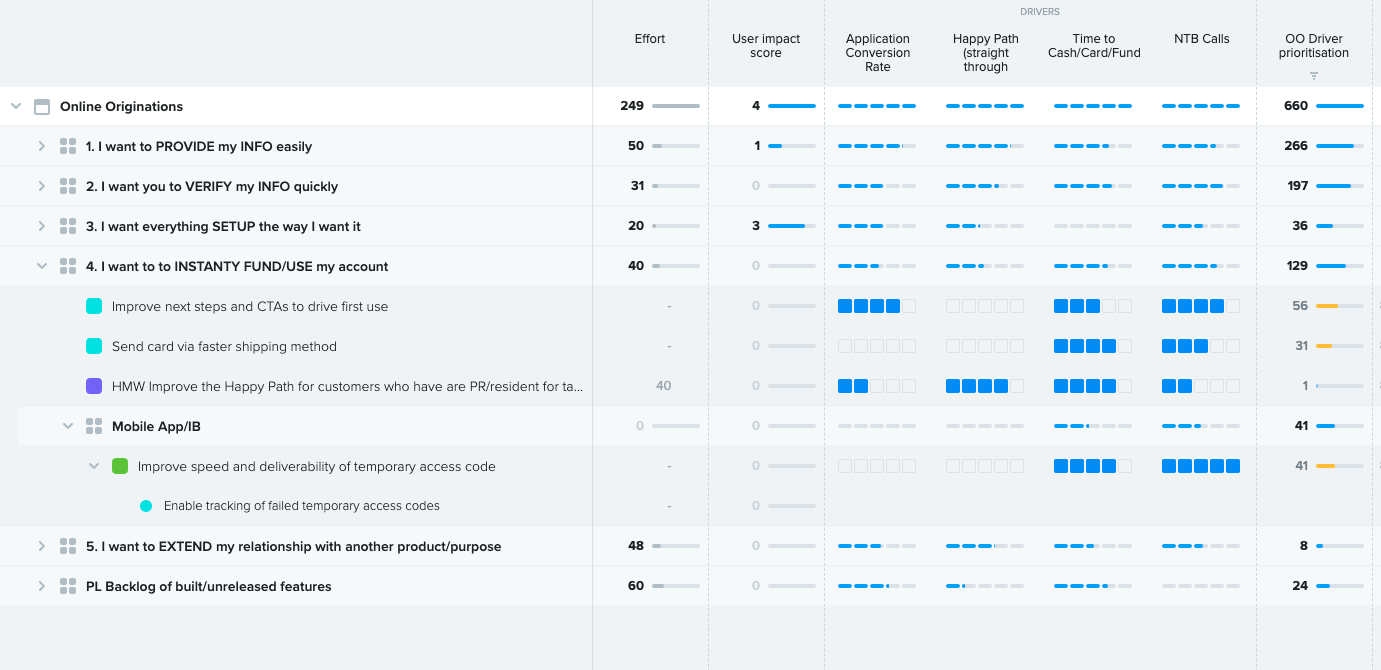

I structured the team's backlog around the 'tasks to be done' in order for a customer to provide information, have it efficiently verified and then enable the customer to use their products as fast as possible.

Backlog items were then scored against their impact on our main metric drivers

RESULTS

- 20%+ increase in straight through processing of applications

- 60% reduction in call to the contact centre from new customers within the first 2 weeks

- 8.9/10 customer satisfaction score

CASE STUDIES